Professional FX traders are constantly thinking about the balance between risk and return and because of that, one of the most popular indicators is the Sharpe ratio. Created by William Sharpe in 1996, it had gradually grown into one of the most popular metrics for an investment’s performance.

We are at a time of great uncertainty, even though financial markets are not factoring that in, yet. We don’t know yet the implications of a Joe Biden Presidency on the FX market and whether or not, inflation or deflation will dominate the next few years. As a result, we talk to provide a brief introduction to the Sharpe Ratio and why it would be important for you to track it.

What is the Sharpe Ratio?

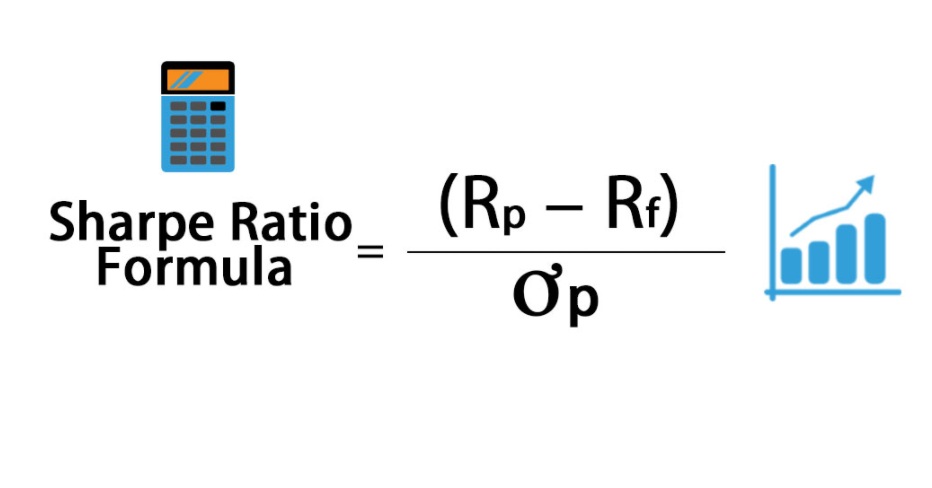

The Sharpe Ratio or the Sharpe Index is a measurement of reward to variability, explaining an investment’s performance as a difference between the average returns and risk-free returns, divided with volatility.

Usually speaking, a good Sharpe Ratio is above 1, one above 2 is considered as very good, and above 3 excellent. Calculating the indicator could be done by hand, but now that we FX traders can automate the process, it would be much easier to use an EA such as myfxbook.com and the value of the Sharpe Ratio will be calculated automatically for any given period you want.

A negative Sharpe Ratio is generally regarded as bad because it shows a portfolio had underperformed its benchmark. At the same time, combined with high volatility, a portfolio with negative excess returns can be punished, resulting in large losses.

Why should you look at the Sharpe Ratio?

Although for beginners it might not seem like a big deal, the Sharpe Ratio can have a meaningful effect on your risk management regime. Keeping risk under the right parameters is key, especially when FX markets are extremely uncertain.

The trading conditions are changing, sharp correction can occur at any point, but the effectiveness of the risk management will always be the same. As a result, keep in mind to stick with the pre-defined risk rules, stick to the % of your account at risk on every trade, place optimal stop losses, and take profits. In doing so, the Sharpe Ratio will continue to be above 1, and aside from the consistent profitability, it can also serve as a good “resume” in case you are looking to start managing funds for other companies.