5 Stocks to Keep an Eye on in the Trustpac Online Investing Platform

Trustpac

Details

| Broker | Trustpac |

|---|---|

| Website URL | https://www.trustpac.io/ |

| Founded | 2020 |

| Headquarters | England |

| Support Number | +44 2039496389 |

| Support Types | email , live chat , phone |

| Languages | English |

| Trading Platform | Web-trading platform |

| Minimum 1st Deposit | $250 |

| Minimum Account Size | $250 |

| Leverage | Up to 1:100 |

| Free Demo Account | |

| Account Types | Standard |

| Deposit Methods | Credit/Debit card and Bank wire transfer |

| Withdrawal Methods | Credit/Debit card and Bank wire transfer |

| Number of Assets | 100+ assets |

| Types of Assets | Forex, Shares, Futures, crypto currencies, Indices & commodities |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score | 88 |

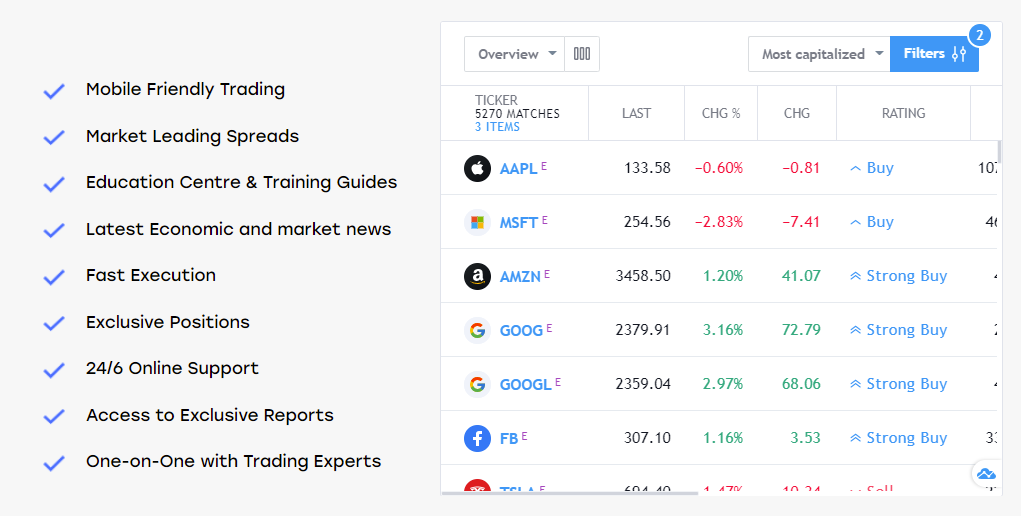

Stocks remain some of the most volatile assets in the world, as aggressive monetary and fiscal interventions have led to a flight from cash into liquid instruments, which can protect the investor from the diminishing purchasing power of money. Trustpac is a place where people can find an innovative investing platform, packed with numerous features, and also several important stocks that should be watched in the near term.

Apple (AAPL)

Still among the most valuable companies listed in the USA, Apple is a very profitable name that all traders and investors should continue to monitor. It has recently published earnings for the first quarter of 2021, and numbers were above expectations, as AAPL posted solid revenues and improved its guidance for the rest of the year.

On top of the solid fundamentals, it is also important to consider the implications of higher inflation and interest rates, which are expected to weigh on tech stocks. If these two variables remain among the market’s priorities, the AAPL stocks will continue to be volatile, generating short-term trading opportunities on both the upside and the downside.

Tesla (TSLA)

The electric vehicle manufacturer has been in the spotlight for the past year, especially after the US elections, when the prospects for “Green investments” over the mid-term improved. Although many other companies continue to join the industry, shifting away from fossil fuels, TSLA holds a competitive advantage due to its longer track record.

On the downside, however, a very high stock price, combined with a high P/E ratio, can create a proper environment for sharper pullbacks. Trustpac offers the ability to buy and sell-short TSLA stock derivatives, something that its customers can take advantage of at any point.

Qualcomm Incorporated (QCOM)

Global chip shortage is among the top themes of the year, creating numerous problems for companies in need of these parts. Computers, phones, and cars need them to function well and already, numerous manufacturers cut production forecasts for the year due to this factor. Qualcomm is one of the leading chip manufacturers and as long as this narrative continues to dominate, it should be one of the stocks to watch on the Trustpac investing platform.

AIRBNB (ABNB)

Currently part of the Trustpac special events section, AIRBNB continues to be a trending stock among both institutions and retail individuals. Founded in 2008, in San Francisco, California, the operator of an online marketplace for lodging and tourism activities is valued at $107.8 in market capitalization. Just like during the 2008 financial crisis, the demand for such services could pick up, but only after the reopening accelerates further and the pandemic is under control.

JP Morgan Chase (JPM)

In an environment where interest rates are rising, bank stocks can profit. JP Morgan Chase has been posting solid gains over the past few quarters, on the back of improving risk sentiment and growing revenues. If a year ago the bank was forced to pile up reserves to counteract any negative impact of the pandemic, it is now gradually releasing them, creating a better environment for the JPM stock.

Is Trustpac offering access to popular stocks?

Favorable stock market conditions have acted as an incentive for Trustpac, which is now offering access to a huge selection of stock instruments. Out of all the companies covered, several stocks stand out as being heavily traded for the time being. Using the Trustpac investing platform is one of the ways to get involved in one of the most active asset classes in the world, taking advantage of a variety of trading tools and features.

Visit Broker