Apsocial Finance Review: The Brokerage’s Major Features

Apsocial Finance

Details

| Broker | Apsocial Finance |

|---|---|

| Website URL | https://apsocialfinance.com/ |

| Founded | 2024 |

| Headquarters | Shepherdess Walk, London, N1 7LB - |

| Support Number | /+61287664968 |

| Support Types | Phone, email, call-back form |

| Languages | English |

| Trading Platform | WebTrader |

| Minimum 1st Deposit | Not stated |

| Minimum Account Size | 12,500$ |

| Leverage | Varied |

| Spread | Varied |

| Free Demo Account | |

| Account Types | Standard, Silver, Gold, VIP Platinium |

| Deposit Methods | Credit/debit cards, bank wires |

| Withdrawal Methods | Credit/debit cards, bank wires |

| Number of Assets | 3,500+ |

| Types of Assets | Stocks, commodities, indices, forex, crypto, metals |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score |

Introducing The broker

Apsocial Finance is an online brokerage firm committed to making online trading easily accessible for anyone eager to dive into the trading world. On the surface, it appears to have a wide range of trading instruments and some other features that have the potential to satisfy customers out there.

Since we understand that choosing the right trading brand can be a challenging task, we help you by offering this in-depth review. We see all of the most important company features with our own eyes, and the article below is meant to give readers an honest view of its services and products. Stay with us until the end if you want to know more about it.

MT4 Trading Platform

Apsocial Finance enables users to trade on one of the most popular trading venues in the world, MetaTrader 4. It’s well known for its reliability, stability, and advanced analytical functions. Using this platform, you are able to buy and sell any of the assets offered by the broker. You can also conduct in-depth market analysis and develop trading strategies by taking advantage of charting tools and technical indicators integrated inside the trading hub.

Another critical benefit of Apsocial Finance’s MT4 offering is the support for managing risk through stop-loss and take-profit orders. In a nutshell, its user-friendly interface and a range of functionalities, combined with the ability to manage their accounts from their smartphones or tablets, make it a good pick for both novice and seasoned traders.

Account Types

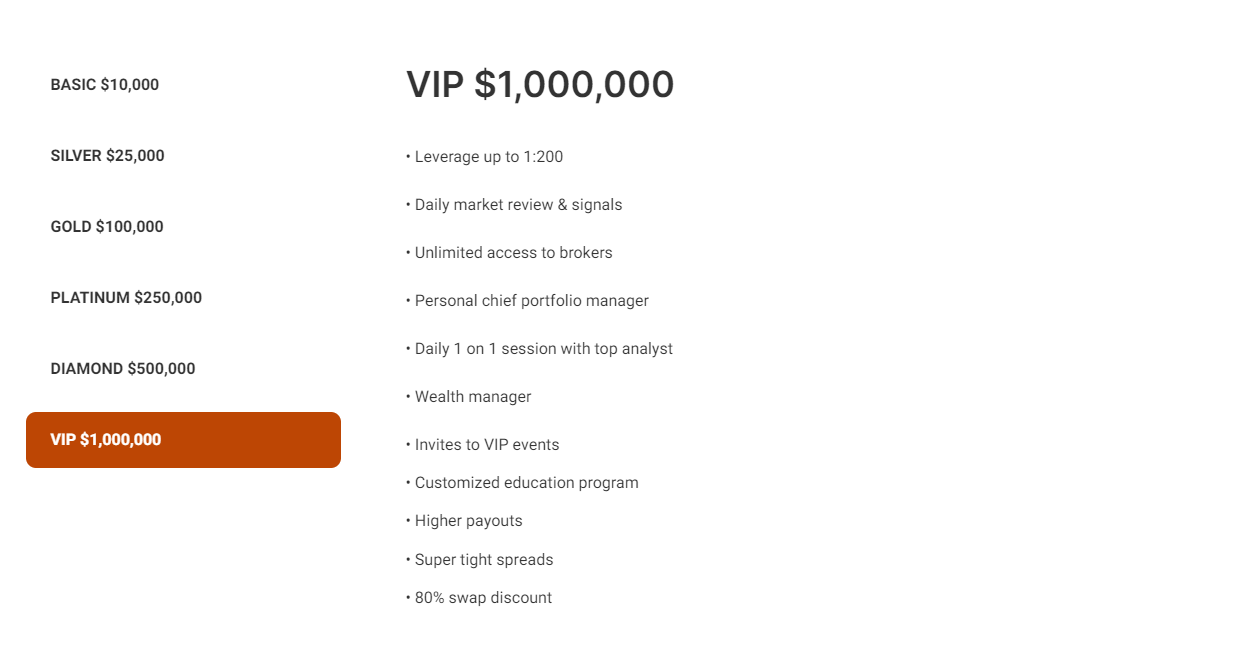

As the company aims to serve traders with varying experience levels and preferences, they have different types of trading accounts. Basic, Sliver, Gold, Platinum, Diamond, and VIP are all of the options available on Apsocial Finance’s platform.

If you are wondering where can I start trading?, then you should go with the Basic account. Although the required minimum deposit of $10,000 is quite steep, you get a list of benefits, which include leverage of up to 1:10, daily news, access to the trading academy to learn more about the markets, weekly market review, support from an account manager, and weekly portfolio progress report.

Regarding the rest of the account options, more trading benefits are unlocked as the deposit grows per tier. The VIP account is the highest level, incorporating the best possible trading benefits at the firm, such as super tight spreads, 80% swap discount, and leverage up to 1:200.

Security

We can’t wrap up this review if we don’t mention the security measures Apsocial Finance has in place. You don’t have to worry about this aspect because the brand operates professionally and pays close attention to traders’s safety.

This is clearly shown through the use of advanced encryption technology to protect the customer’s sensitive data against unauthorized access. They also adhere to strict due diligence measures, including AML and KYC regulations.

Conclusion

This article has addressed some of the most frequent questions traders may have about Apsocial Finance. Any doubts regarding the platform’s reliability and capabilities can be clarified by now. To get a full picture, we recommend trying the platform yourself and exploring the features firsthand.

Visit Broker