ETFinance Review

ETFinance

Details

| Broker | ETFinance |

|---|---|

| Website URL | https://www.etfinance.eu/ |

| Founded | 2018 |

| Headquarters | KPMG Center, 1 Agias Fylaxeos Street, 2nd Floor – Office 1, 3025 Limassol, Cyprus |

| Support Types | live chat , phone , email |

| Languages | 7 languages supported |

| Trading Platform | WebTrader | MT4 | Mobile app |

| Minimum 1st Deposit | 0-250 |

| Bonus | No bonus |

| Leverage | up to 1:500 |

| Spread | fixed/floating |

| Free Demo Account | |

| Regulated |

|

| Regulation | Regulated by CySEC |

| Account Types | Silver , gold, , platinum , Islamic |

| Deposit Methods | credit/debit card , wire transfer , Skrill , others |

| Withdrawal Methods | credit/debit card , wire transfer , Skrill , others |

| Number of Assets | 750+ assets |

| Types of Assets | forex, metals, indices, stocks, commodities, ETFs, future CFDs |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score | 62 |

Since it was founded in 2016, ETFinance had been providing access to trading services for forex and other CFD instruments. With a website available in Spanish, Dutch, German, Portuguese, English, and Italian, we’re talking about a broker that’s focused mainly on the European Area and does not provide access for clients based in the US, Belgium, Japan, Nigeria, and some other sanctioned countries.

Given its focus on Europe, competition is very fierce and a lot of other much bigger companies are providing the same trading services. The company is owned by Magnum FX LTD, being regulated by CySEC and MiFID II (Markets in Financial Instruments Directive). Our review is based on a comparison with the most popular brokers and if you want to know whether it’s worth trading with ETFinance, stick to the end of the article.

Trading Platforms

We begin with the platforms, which are where ETFinance does not provide enough information on the official website. Based on what’s available there, we found that the company provides support for a Webtrader, MetaTrader 4, and a mobile app available for both Android and iOS devices. Assuming the Webtrader is the web version of MT4, we would have expected to see the company providing more information about it. Instead, there’s only a page with limited information about it. No images or other relevant features have been provided.

MetaTrader 4 had been a popular platform for years, but now the MetaTrader 5 seems to be more appealing for forex traders. Since the company did not make any upgrades, that means it was unable to keep up with the latest trends. An upgrade would have been welcomed and in the absence of it, we can notice the company’s inability to constantly innovate and provide the latest trading features.

In terms of mobile apps, they lack popularity in both the App Store or Google Play. If we would have witnessed a very reliable mobile app with many users, we should have seen a lot of positive reviews. There are none on Google Play and neither on the App Store. With no client providing feedback about it, we can assume ETFinance did not have many clients over the years and is not popular among forex or CFD traders.

Account Types

The sole positive aspect when it comes to ETFinance is the provision of Islamic Accounts. However, even those accounts don’t have any interest fees credited or debited, they’re only available for traders providing proof of Islamic faith. Given that company is focused on the European Area, the number of eligible traders is very limited.

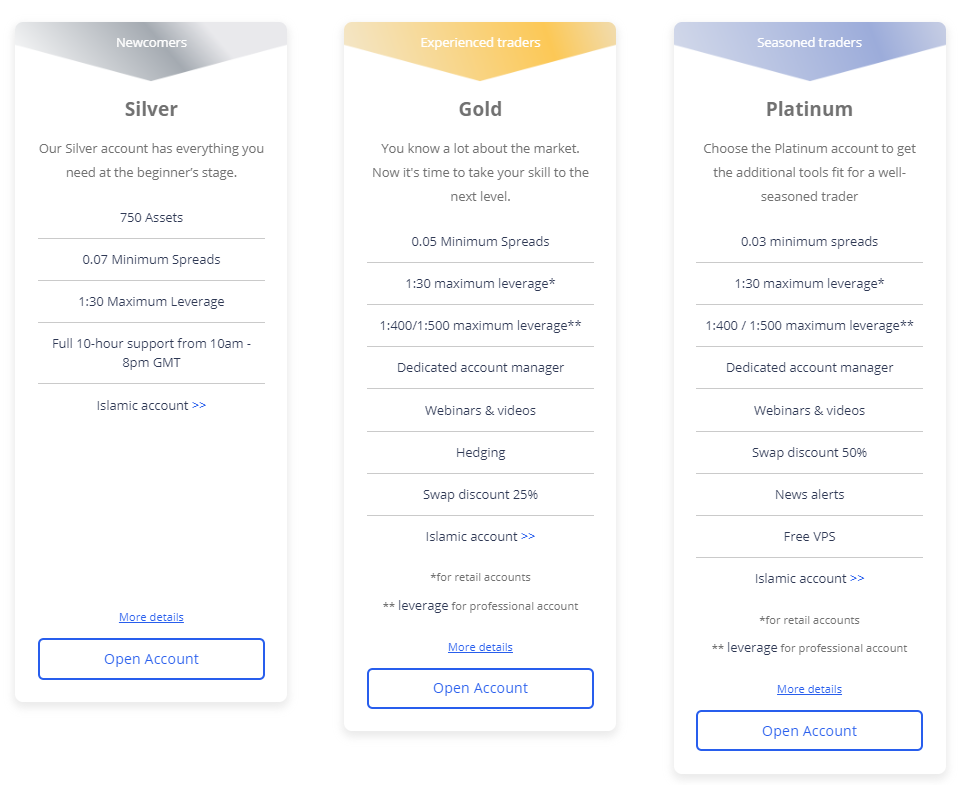

Alt-text: ETFinance account types

Aside from that, Silver, Gold, and Platinum accounts are available with the company. Both retail and professional versions are in play, given the compliance with European regulations. 1:30 maximum leverage for retail and 1:500 for professional. We couldn’t have noticed that the Silver account holders are heavily at a disadvantage, given the limited number of features they get access to. The minimum deposit is $200, but other than access to 750+ assets, customer support, and the ability to open an Islamic account (just for traders of the Islamic faith), there is nothing else. For Gold and Platinum, a dedicated account manager, webinars & videos, hedging, swap discounts, news alerts, and free VPS are some of the trading features.

Since the features are very limited for Silver accounts, it seems like ETFinance wants to make clients open accounts that require a bigger initial deposit. We found it strange, also, to see that there is no mention of how much traders should deposit for each of the accounts.

Trading Instruments

By analyzing the Assets Index, we’ve found information about Forex, crypto pairs, indices, commodities, and stocks. However, under Products, we see mentions of metals and ETFs. This is another proof the company did not update information about the trading instruments currently available. Spreads are floating, leverage variables depending on the asset type and whether the client has a retail or professional account.

Education

In terms of providing educational material, ETFinance does offer access to a dedicated account manager, webinars & videos, Ebooks, and some other resources. However, only registered clients have access, and silver account holders don’t get to use them. Only Gold and Platinum account holders can benefit from all the educational resources.

Conclusion

If we compare what ETFinance has to offer with what other popular brokers are now providing, the conclusion is that there are plenty of other better alternatives for traders wanting to trade forex or other CFDs. ETFinance had not updated the information on its website for a long time and that could suggest a lack of interest from the company at the same time, it shows the number of existing clients is very low. There are a few reasons why we should rank high ETFinance on our website.

Visit Broker