Fibonacci retracement is one of the most popular forex trading strategies, especially when it comes to beginning forex traders. However, the traditional approach many traders have led to weaker accuracy and hence, reduced profitability. In our article, we want to show you a unique approach to Fibonacci trading which will help you factor in other variables, as well. In this fashion, you will be able to anticipate market movements before others and manage to bank in profits.

Fibonacci retracement + Key support/resistance levels

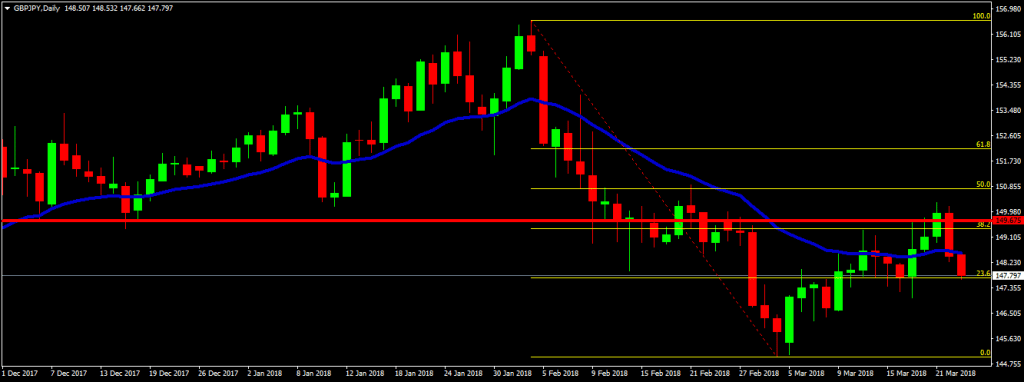

As you can see in our chart below, we’ve drawn the Fibonacci retracement levels on a bearish trend. Since the beginning of February 2018, GBPJPY had been trading on the downside, as fears related to Brexit had been showing up. As you may check, the pair dropped more than 1000 pips, which is an impressive impulsive move.

However, since the beginning of March 2018, the pair began to recover, as pressures begun to diminish. The 23.6 % level had shown little signs of intense selling activity and had been broken. The fundamentals were shifting and sterling managed to recover a few hundred pips.

However, the price ran into a strong resistance area yesterday, March 22nd 2018, and the area where it started to drop is around the 38.2 % Fibonacci level. The area played out nicely and at the time of writing, the price is down by more than 200 pips.

What we want to emphasize here is also a key resistance level 149.67, which is drawn with red. The 38.2 % Fibonacci level had held thanks to this resistance level as well. This is one of the key elements you need to understand. You need to find confluence between more indicators, not just one.

In this way, you will manage to spot key areas and you will be able to manage risk like a pro. This is absolutely critical when trading forex and you should take into account the advice we’ve mentioned.

Also, don’t forget to take into account the fundamental and sentiment analysis, besides the technical aspects.

To summarize, this is how you should approach Fibonacci trading, in order to ensure a higher level of profitability trading forex. With enough practice, you will be able to spot many other opportunities like the one in