The United Kingdom economy begins to show signs of weakness as the latest GDP figures remained unchanged at 0.3% MoM and 1.7% YoY in the second quarter. Forex market activity had not been too volatile thus far since the numbers came in line with expectations. However, the downward path of the GDP should continue to add extra pressure on sterling in the upcoming months.

UK economy continues to slow down

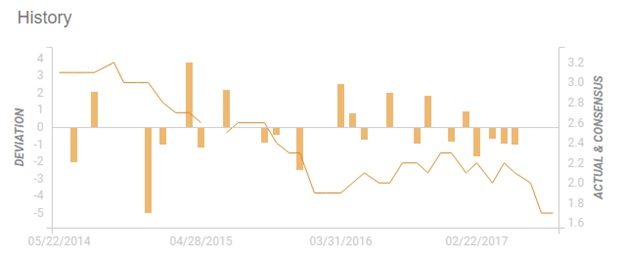

Looking at the chart above, since late 2014 the UK economy had entered a downward path, decreasing from a 3% growth to 1.7% percent growth on a year to year basis. Since the numbers are continuing to show signs of weakness, recent expectations regarding the BOE intentions to raise the interest rate had faded. Slowing GDP growth combined with decreasing inflation figures should not pose any treats of an overheating economy. Also, the uncertainty around the Brexit negotiations should be a major treat for the future economic development of the UK.

As more and more companies are willing to move outside of UK, in order to avoid any damages created by a failed negotiation with the European Union, the bearish trend of the GDP development might continue. There is still no information on how the negotiation will take place and further notice is expected around the end of the year. The market still expects it to be rough so caution would most likely be at high points.

Forex market activity around sterling should also be volatile. For the last four weeks it has lost ground against most major currencies. The most significant one is against the US dollar, the price moving from mid-1.3200 area towards 1.2800 zone. As the GDP numbers came in line with expectations, we’ve seen some relief after the release, with sterling managing to gain some ground against the US dollar. However, looking at the big picture, the bearish sentiment is still intact as the fundamental background does not support a sterling recovery.

Looking ahead, as the UK economy does not have an encouraging development, sterling should continue to be under pressure and also equities could have a poor performance.

Risk Warning and Disclaimer

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Past performance is no indication or guarantee of future performance.