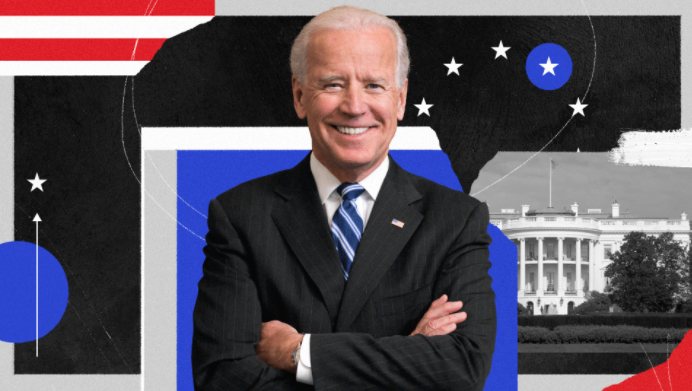

Although there are still votes to be counted and the prospects for a contested result alive, the latest numbers are projecting a change of power at the White House. Joe Biden promised to be a different president and truly, his mandate is expected to bring major changes. For us, forex traders, the most important aspects would have to do with how financial markets will be impacted.

More fiscal spending = weaker US dollar

The Democrats had promised higher spending and with economic prospects weakened by the ongoing pandemic, the only way to get that done would be via a combination of higher taxes and higher debt issuance. Fiscal policy is now under the spotlight and increased government spending in the US will very likely keep the US dollar weakened.

Risk currencies like EUR, GBP, or AUD will be favored, as long as there aren’t more aggressive fiscal responses in their respective countries. Dollar weakness could be the “name of the game” in the short-term, but we should consider that other nations could follow on the same path as the US. Currencies are valued one against each other so we’ll have to see what currencies will end up more valuable.

Divided Congress to keep deflationary risk alive?

Regardless of the Democratic plans for the next 4-years term, Republicans managed to hold on to the Senate majority, which will be key to passing a new large stimulus bill. Negotiations will be tough and spending could ultimately disappoint.

In that case, the US dollar weakness will be limited, and safe haven assets such as the Yen or Swiss franc could rise. The next few weeks will provide new clues on the near-term fiscal path and based on that, forex traders should decide on the major trends looking forward.

Foreign policy another key aspect to watch

With the change at the White House, changes in foreign policy are expected to occur as well. Protectionism will take a break as Biden is a candidate supportive of the globalist agenda. If that will be the case, the case for a weaker dollar will be reinforced. However, the rising of China as the main US rival won’t spot and the spat between the two nations will continue.

Business activity is heavily influenced by geopolitical changes, which is why uncertainty will remain elevated even now that foreign policy could be more predictable. How do you think the US election will impact FX over the medium and long-term?