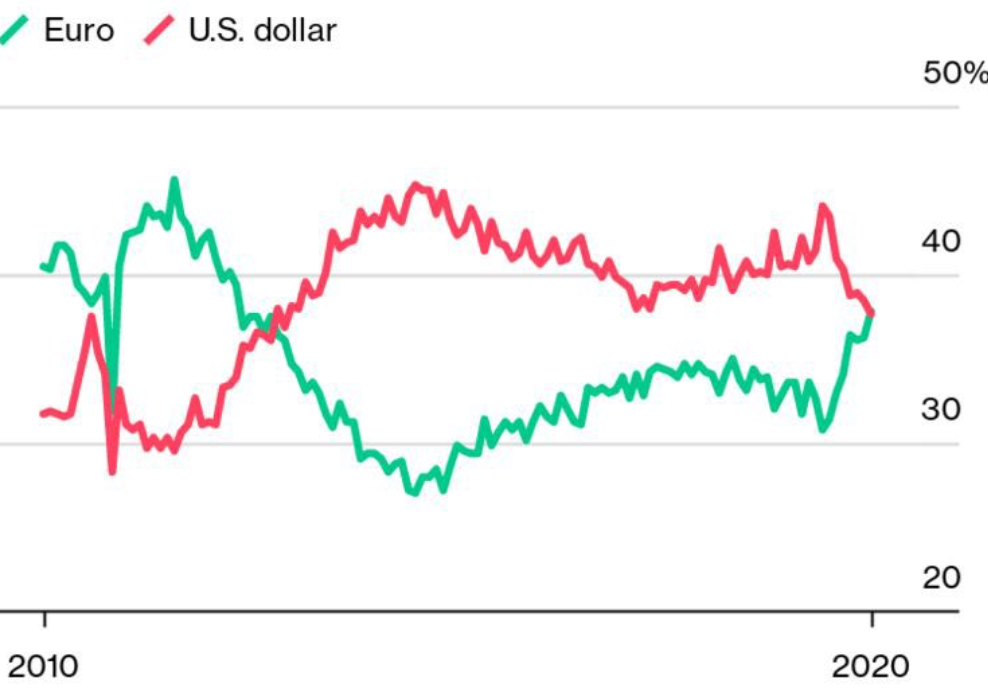

Aggressive monetary intervention from the Federal Reserve had put pressure on the US dollar and in combination with several other factors, the global reserve currency was overtaken by the Euro as the top global payments currency. There had been a lot of debate around the Euro strength, especially since the EU is facing a more severe economic contraction this year.

If last time we’ve talked about the Sharpe Ratio, today we want to analyze some of the tailwinds pushing the world towards the Euro and away from the US dollar.

# Monetary policy

Although the US dollar is still the global reserve currency, what the Fed had been doing this year had been one of the main reasons leading to a shift towards the Euro. The DXY or the dollar index, continues to be subdued, trading around 93, not far from the 2020 lows. The debt denominated in dollars globally is extremely high and as a result, monetization would be more aggressive.

# International trade

The economic downturn induced by the coronavirus pandemic influenced international trade and thus the total value of dollar payments. Commodities prices in USD are liquid and large institutions had been relying on them for decades. However, reduced economic activity means fewer goods and services are transacted globally.

Transportation continues to be one of the sectors still severely hit. The second wave of the pandemic is here and even though two vaccines could be available since December, the winter will be a great challenge, especially for the Northern Hemisphere.

# Rising political tensions

There is no secret that the US global dominance had been weakening during the past few decades and thus political tensions are seen rising. However, it still kept financial dominance and military capabilities, but if we look at its share in the global economy, two power centers are shaping up – the European Union and China.

Other countries are fully aware the USD can be used as a political weapon in case things will get worse and because of that, we see the shift towards other alternatives. Could the Euro rise be only temporary, given the economic hurdles the Common Block will face, or this time the shift will be permanent?

As seen in the Bloomberg screenshot at the beginning of the article, this isn’t the first time the Euro overtakes the Dollar, but things could change again in case the USA will be the first one to start raising interest rates.